6 Mins Read

Three new reports from the nonprofit The Good Food Institute detail a shifting landscape across the global food system as the plant-based, precision fermentation, and cultivated meat sectors show significant growth and widespread acceptance.

The trio of Good Food Institute (GFI) reports comes on the heels of the 2022 industry snapshot report from the Plant Based Foods Association, published earlier this week. Both organizations’ reporting shows major market potential: the plant-based food sector hit a record $8 billion in sales last year as the nascent cultivated meat and precision fermentation sectors raised nearly $2 billion combined while plant-based innovators raised $1.2 billion.

“Alternative proteins are a scalable solution that, with proper levels of public and private support, can help address the biggest challenges of our time and transform our global food system for the better,” GFI says in its report. While several of the sectors experienced deceleration last year, the organization remains largely optimistic, highlighting milestones, such as mainstream food brands adding vegan versions of iconic products, record fundraising, and innovations that aim to solve some of the world’s biggest issues including food security and climate change.

The plant-based sector

Jumping off from the recently released PBFA report, GFI paints a similar picture: consumer interest in plant-based proteins is on the rise around the world, and retailers and manufacturers are responding. Intellectual property for plant-based meat alone has tripled in the last decade, the report notes.

“As consumer engagement with, and interest in, plant-based proteins increases around the world, retailers and manufacturers are leaning in, introducing new products, developing strategic partnerships, and building new production facilities,” GFI says. “Public sector participation is also increasing, with more governments around the world investing in plant-based proteins as a research and commercialization priority.”

Noteworthy achievements run the spectrum but the industry’s staying power is perhaps best demonstrated by fast-food giant Burger King, which not only expanded its plant-based offerings but also opened a dedicated plant-based location and one where vegan meat is the default protein option.

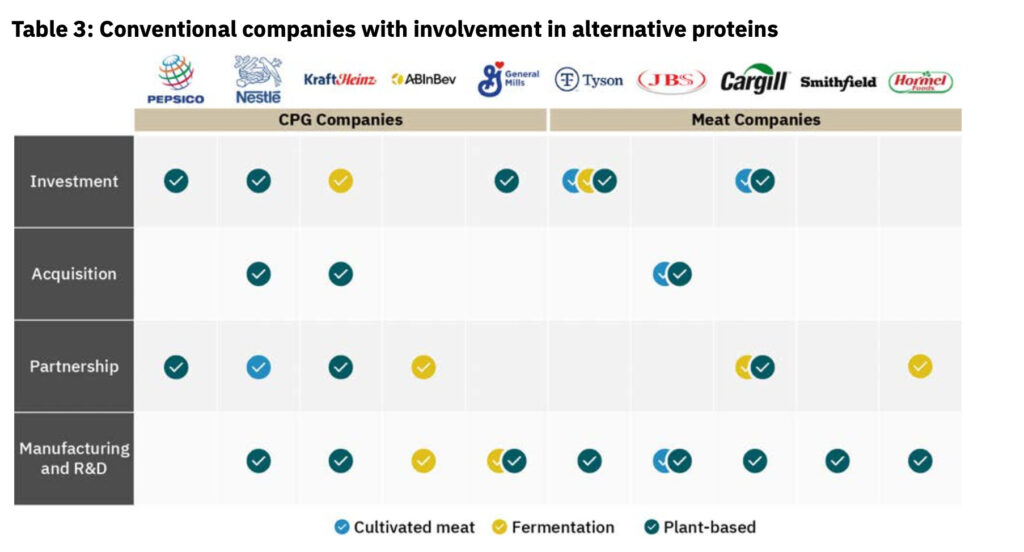

Mainstream retail brands also embraced the trend with Kraft Heinz, Kellogg, Nestlé, and the Bel Group launching or expanding their plant-based offerings. Today, Bel Group announced it will be working with AI to further improve on its vegan versions of popular Babybel, Boursin, and Laughing Cow cheese ranges.

“Food is a key lever to address climate change, and we, at Bel, have a strong determination to explore new territories and develop innovative solutions that will define the future of food, for all,” Cécile Béliot, CEO of the Bel Group, said in a statement. The company is partnering with newcomer Climax to develop cheese Bel says is “indistinguishable” from its dairy-based offerings. “This collaboration epitomizes our co-innovation strategy by combining their distinctive technological data science and AI platforms and expertise with Bel’s pioneering and historical knowledge,” Béliot said.

Michal Klar, Founding Partner of Better Bite Ventures and Editor of Future Food Now newsletter says the three key areas driving consumer adoption of plant-based products are “price, taste and nutrition.”

“What makes me hopeful is how many dedicated founders, investors, nonprofits and industry folks are working every day to address these,” Klar says. “I am confident it will lead to better products and increased adoption.”

Cultivated meat

Global meat production is projected to nearly double by 2050, GFI says. “But the way the world currently produces meat cannot meet this demand and still achieve global climate, food security, public health, and biodiversity goals.”

According to the report, there is a growing understanding of the importance of “finding viable alternatives” to industrial animal agriculture, and “huge opportunities for companies who get involved in this space.”

“Just as the world is changing how energy is produced, we need to change how meat is made,” GFI says.

Cultivated meat shows promise in solving the problem, according to the 2022 highlights. The U.S. FDA completed its first premarket review of cultivated meat, granting California’s Upside Foods a “no questions” clearance.

The industry saw nearly $900 million in funding, with Upside Foods and fellow California-based cultivated startup Wildtype nabbing more than half of it at $400 million and $100 million respectively.

Unique investors in the space also grew 19 percent with 679 investors for the year with average investment sizes higher than in 2021.

Precision fermentation

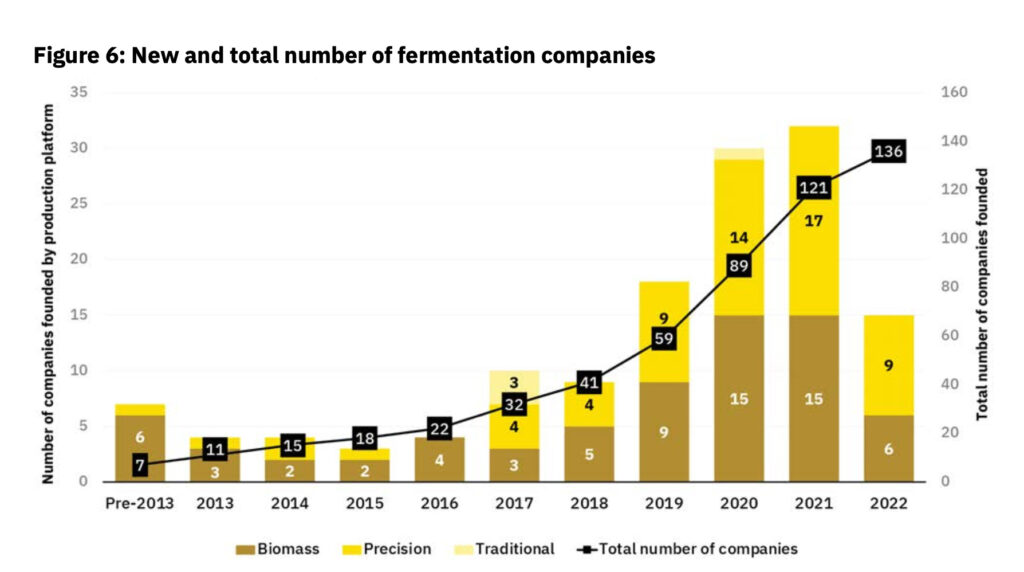

The dark horse in this race though appears to be precision fermentation. GFI notes that while funding decelerated YoY in an unstable market, there are still significant progress markers for the novel tech sector. The APAC region saw fermentation funding grow nearly 70 percent and Europe grew 37 percent. The category also saw its unique investors jump 38 percent to more than 700, a “trend likely to continue,” GFI says.

Most notable is fermentation’s mainstream appeal with multinational food companies including Mars, Nestlé, Unilever, and now the Bel Group, announcing investments into the space that now includes dairy, egg, and seafood successors.

Dairy has fallen out of favor with younger generations and as lactose-intolerant populations look elsewhere, dairy-free milk has been the category leader in the plant-based sector. It now makes up 15 percent of all fluid milk sales. But a report from Olam Food Ingredients earlier this month shows consumers are still shopping for a favorite. According to that report, seven percent of consumers who purchase dairy-free products revert to dairy, and more than 30 percent say they haven’t found a dairy product that meets their needs.

Precision fermentation could be that product.

“In the past year fermentation has become the forefront of the industry, mainly due to the food tech sphere shifting strongly towards the climate tech space with more investors coming into the picture and a deeper understanding of the significant role food can play in mitigating climate change,” Yonatan Golan, CEO of microalgae producer Brevel says in the report.

“This shift also drives the focus further upstream to ingredients and manufacturing rather than consumer brands and plant-based applications,” Golan says. “In the next 1-3 years I believe we will see more and more pilot scale and small commercial scale facilities shifting gears into commercial manufacturing, alongside a rise in consumer applications containing microorganism-based ingredients.”

The fermentation report also explores molecular farming, a sector still very much in its infancy. GFI cites a dozen companies using the tech to grow dairy proteins and growth factors used in cultivated meat. Molecular farming involves introducing animal DNA into seed crops that then are grown and harvested via traditional farming methods but with the added protein.

GFI says across all sectors, advances in alt protein science and technologies are “happening fast,” as more researchers and funding flow into the field.

“The policy and regulatory landscape is just starting to take shape,” GFI says. “Consumers want sustainable options, but they don’t want to compromise on taste, price, or convenience. Navigating and building the path to scale and adoption will take years. Staying on this path while overcoming obstacles and headwinds will be critical to success.”