I was on a call with Broadcom last week. A representative from a bank was also on the call and talked about how their use of a mainframe computer was connected to their commitment to security, reliability, and availability for their customers. In an earlier IBM call with some banks, they all indicated that their use of the mainframe helped them make better decisions, as well.

These conversations got me wondering if the recent failures of Silicon Valley Bank and First Republic Bank had something to do with whether they used mainframes. While this is a small sample, neither of the failed banks (according to this report) used mainframes, while JPMorgan Chase & Co., the bank that bought First Republic, does.

There is a decent chance that banks using mainframes prioritize low risk, while banks that do not may be more willing to take unreasonable risks. With people currently concerned about where to put their money safely, one of the questions you should ask is, “Do you use a mainframe for your mission-critical applications?”

Let’s explore the relationship between mainframes and banking risks. Then we’ll close with my Product of the Week, a little device that could allow your smartphone battery to last indefinitely. I had doubts, given how the device looked, but it does perform as advertised.

Mainframe Administration Challenges

The first really big company I worked for was IBM. That was right at the birth of the PC, and, back then, compared to PCs, mainframes sucked. Don’t get me wrong. Mainframes were far more reliable and secure, but you needed MIS (now called IT) to do everything for you. That organization seemed to enjoy getting every request wrong and using an execution schedule measured in years.

We used to joke that getting anything out of MIS required sacrificing a chicken and dancing naked around a fire, though HR frowned on doing that, so we never validated the theory. With a PC and, later, a server, you could get things done much more quickly and meet your deadlines.

But along with that improvement in flexibility, we went from uptime measured in years to uptime measured in hours. Both platforms changed over time: mainframes evolved to be more flexible without giving up security, reliability, and availability, and PCs remained easier to use but made considerable improvements in security, reliability, and availability, though they still lag the mainframe significantly.

Mainframes tend to be more expensive and difficult to administer due to a talent shortage, but IBM, Broadcom, BMC, and others have aggressively moved to increase training. While the lack of trained people has somewhat relaxed, it is generally still harder to find a good mainframe staff than it is to find a good x86 server staff.

Mainframes and Banks

Mainframes exist in critical mass in three verticals: banking, health care, and government. But banking has been the most aggressive at preserving this technology overall. Why? Because typically, banks need to maintain a solid reputation and meet heavy regulatory requirements, and find mainframes are better at balancing cost and risk than most other segments.

Therefore, the selection and sustained use of a mainframe by a bank may be a direct indicator of how well the bank internally manages risk. In other words, banks that have mainframes place risk mitigation in front of cost, while banks that do not may place cost over risk mitigation.

Not properly managing risk has been connected to both the recent Silicon Valley Bank and First Republic Bank failures, suggesting the connection between risk mitigation and the selection of technology to be at least anecdotally connected. While it is clearly neither the only nor the absolute indicator of sound risk management, mainframe use may be one of the most easily acquired indicators of a bank’s risk vs. profit priorities.

Unreasonable Risk Behavior Is Hard To Identify

I am an ex-internal auditor, and I can say from experience that, even when inside the company, identifying unreasonable risk behavior before a catastrophe is challenging. What you look for are things like rapidly rising meal and entertainment expenses, dating between managers and subordinates, unusual acquisitions, or executive salaries and expenses out of line with industry norms.

But I think the use of the mainframe may be an even better indicator because the mainframe is a large enough capital expense to be material to a bank, and the reasons to buy and maintain a mainframe are closely coupled to a high focus on lowering risk when a bank chooses to take a profit hit to mitigate risk.

As I write this, I checked to see whether the financial institution I use (which I will not mention for personal security reasons) uses a mainframe. It does, and suddenly I am less worried it might go under — not that I ever did worry before the recent failures.

Wrapping Up

Mainframe use is tied directly to prioritizing reliability, availability, and security over absolute profitability. Given that the recently failed banks prioritized short-term profitability, I think one of the ways to determine if your bank is likely to be making high-risk decisions you do not know about is to find out if they use a mainframe.

Like many of you, I worry that my retirement funds are safe, given the recent bank failures. Knowing they are in a company that has chosen to use a mainframe gives some additional peace of mind. I am not saying a bank that does not use a mainframe is unsafe, only that this decision may indicate a more significant problem connected to that bank’s priorities that would now be concerning given the recent failures.

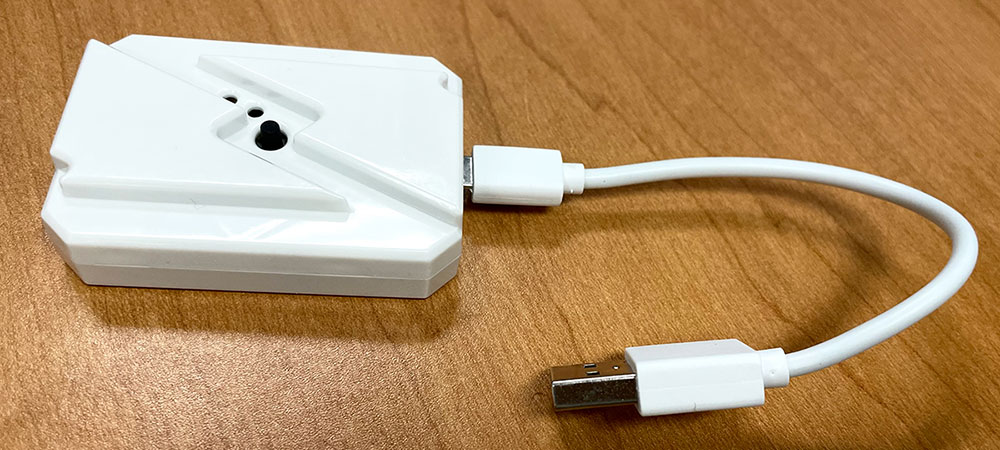

Charge-Check by LAVA

My personal favorite phone is the Microsoft Surface Duo 2, which I will soon replace with the new Lenovo ThinkPhone. One of the reasons why is that I typically plug my phone into a fast charger at night, and battery life has been getting steadily worse over time.

So, when LAVA contacted me to try its Charge-Check, a device designed to keep the battery from degrading, I was interested, though skeptical. I was the lead battery analyst for much of the world for several years and found that gadgets like this are often frauds.

That said, I have been using Charge-Check for several weeks now, and it does exactly what LAVA said it would do. Initially, it charged the device to peak and then shut off. I was concerned that you would often end up with a healthy but dead battery, but that was because I hadn’t read the instructions (definitely my guy genes kicking in).

If you use the button, which sets between-charge time-outs, I suggest hitting the button twice and holding after the last push for 10 seconds for a two-hour cooling time. However, if the display is on while charging, the one-hour interval would likely better ensure you don’t have a dead battery. Your phone will almost always be near capacity, and your battery should last indefinitely.

Given that new phones can cost over a thousand dollars and replacing the batteries can cost $100 or more depending on the phone, this little $29.99 device is a decent investment.

I’ll add that LAVA, the parent company, is Ukrainian and Canadian-owned, and I like to do whatever I can to help Ukraine, which made the decision to select the LAVA Charge-Check as my Product of the Week rather easy. Plus, it keeps me from burning through phones as quickly because I hate switching phones.

The opinions expressed in this article are those of the author and do not necessarily reflect the views of ECT News Network.